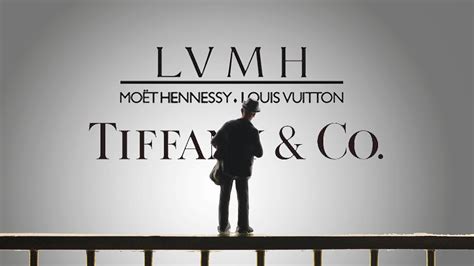

louis vuitton tiffany acquisition | lvmh tiffany stock louis vuitton tiffany acquisition LVMH has agreed to go ahead with its acquisition of Tiffany at a slightly lower price, approving a $15.8bn deal and ending a bitter conflict triggered by the Covid-19 . Diplomātiskā servisa medicīnas centrs, SIA. Adrese Baznīcas iela 18, Rīga, LV1010 ; Mājas lapa http://www.dsmc.lv; Telefons 67229942 ; E-pasts

[email protected]

0 · who owns tiffany

1 · tiffany acquisition lvmh

2 · lvmh tiffany stock

3 · lvmh tiffany price

4 · lvmh tiffany net worth

5 · lvmh tiffany deal

6 · lvmh tiffany controversy

7 · did lvmh pay for tiffany

$2300 & FREE Shipping. 60W Electronic Low Voltage Halogen Transformer HD60-120. Brand: Import. 4.0 24 ratings. | Search this page. Amazon's Choice in Lighting Low Voltage Transformers by Import. $2397. Get Fast, Free Shipping with Amazon Prime. FREE Returns. About this item.

who owns tiffany

French luxury giant LVMH has completed its purchase of US jeweller Tiffany, having previously sought to walk away from the deal. The firm has named a new team to lead Tiffany, which includes a. LVMH Moët Hennessy Louis Vuitton SE, the world’s leading luxury products group, announced today that it has completed the acquisition of Tiffany & Co. (NYSE: TIF), the global . LVMH Moët Hennessy Louis Vuitton SE, the world’s leading luxury products group, announced today that it has completed the acquisition of Tiffany & Co. (NYSE: TIF), the global .The acquisition of Tiffany will catapult LVMH to the top of the rankings for market share in branded jewellery, one of the best-performing luxury categories in 2018, which Bain consultants.

LVMH has agreed to go ahead with its acquisition of Tiffany at a slightly lower price, approving a .8bn deal and ending a bitter conflict triggered by the Covid-19 . LVMH Moët Hennessy Louis Vuitton SE, the world’s leading luxury products group, announced today that it has completed the acquisition of Tiffany & Co. (NYSE: TIF), the global . Louis Vuitton owner LVMH has agreed to buy Tiffany for .2 billion in its biggest acquisition yet, as the French luxury goods maker bets it can restore the U.S. jeweller's lustre by investing.

LVMH Moet Hennessy Louis Vuitton (OTC: LVMUY) shares were trading higher Thursday after the company announced it had completed its acquisition of Tiffany & Co (NYSE: TIF). The deal . Moët Hennessy-Louis Vuitton SE (LVMH) submits an unsolicited takeover offer to the Tiffany & Co. board, valuing the US company at $US120 per share. Tiffany & Co. confirms . LVMH has entered into a definitive agreement with Tiffany & Co. to buy the US jewellery company for .2 billion. Pending approval from Tiffany’s shareholders and . French luxury giant LVMH has completed its purchase of US jeweller Tiffany, having previously sought to walk away from the deal. The firm has named a new team to lead Tiffany, which includes a.

LVMH Moët Hennessy Louis Vuitton SE, the world’s leading luxury products group, announced today that it has completed the acquisition of Tiffany & Co. (NYSE: TIF), the global luxury jeweler. LVMH Moët Hennessy Louis Vuitton SE, the world’s leading luxury products group, announced today that it has completed the acquisition of Tiffany & Co. (NYSE: TIF), the global luxury. The acquisition of Tiffany will catapult LVMH to the top of the rankings for market share in branded jewellery, one of the best-performing luxury categories in 2018, which Bain consultants.

LVMH has agreed to go ahead with its acquisition of Tiffany at a slightly lower price, approving a .8bn deal and ending a bitter conflict triggered by the Covid-19 pandemic that threatened. LVMH Moët Hennessy Louis Vuitton SE, the world’s leading luxury products group, announced today that it has completed the acquisition of Tiffany & Co. (NYSE: TIF), the global luxury jeweler.

Louis Vuitton owner LVMH has agreed to buy Tiffany for .2 billion in its biggest acquisition yet, as the French luxury goods maker bets it can restore the U.S. jeweller's lustre by investing.

LVMH Moet Hennessy Louis Vuitton (OTC: LVMUY) shares were trading higher Thursday after the company announced it had completed its acquisition of Tiffany & Co (NYSE: TIF). The deal makes.

Moët Hennessy-Louis Vuitton SE (LVMH) submits an unsolicited takeover offer to the Tiffany & Co. board, valuing the US company at $US120 per share. Tiffany & Co. confirms it has received the offer on 28 October, and its share price jumps 32 per cent.

LVMH has entered into a definitive agreement with Tiffany & Co. to buy the US jewellery company for .2 billion. Pending approval from Tiffany’s shareholders and regulatory authorities, the all-cash deal — the largest-ever transaction in the personal luxury goods space — will likely go through in mid-2020. French luxury giant LVMH has completed its purchase of US jeweller Tiffany, having previously sought to walk away from the deal. The firm has named a new team to lead Tiffany, which includes a. LVMH Moët Hennessy Louis Vuitton SE, the world’s leading luxury products group, announced today that it has completed the acquisition of Tiffany & Co. (NYSE: TIF), the global luxury jeweler. LVMH Moët Hennessy Louis Vuitton SE, the world’s leading luxury products group, announced today that it has completed the acquisition of Tiffany & Co. (NYSE: TIF), the global luxury.

The acquisition of Tiffany will catapult LVMH to the top of the rankings for market share in branded jewellery, one of the best-performing luxury categories in 2018, which Bain consultants.

tiffany acquisition lvmh

LVMH has agreed to go ahead with its acquisition of Tiffany at a slightly lower price, approving a .8bn deal and ending a bitter conflict triggered by the Covid-19 pandemic that threatened. LVMH Moët Hennessy Louis Vuitton SE, the world’s leading luxury products group, announced today that it has completed the acquisition of Tiffany & Co. (NYSE: TIF), the global luxury jeweler.

Louis Vuitton owner LVMH has agreed to buy Tiffany for .2 billion in its biggest acquisition yet, as the French luxury goods maker bets it can restore the U.S. jeweller's lustre by investing.LVMH Moet Hennessy Louis Vuitton (OTC: LVMUY) shares were trading higher Thursday after the company announced it had completed its acquisition of Tiffany & Co (NYSE: TIF). The deal makes. Moët Hennessy-Louis Vuitton SE (LVMH) submits an unsolicited takeover offer to the Tiffany & Co. board, valuing the US company at $US120 per share. Tiffany & Co. confirms it has received the offer on 28 October, and its share price jumps 32 per cent.

lunette solaire dolce gabbana homme

181 Followers, 13 Following, 91 Posts - See Instagram photos and videos from DINOSS (@dinoss.lv)

louis vuitton tiffany acquisition|lvmh tiffany stock